Price & Volume (8w)

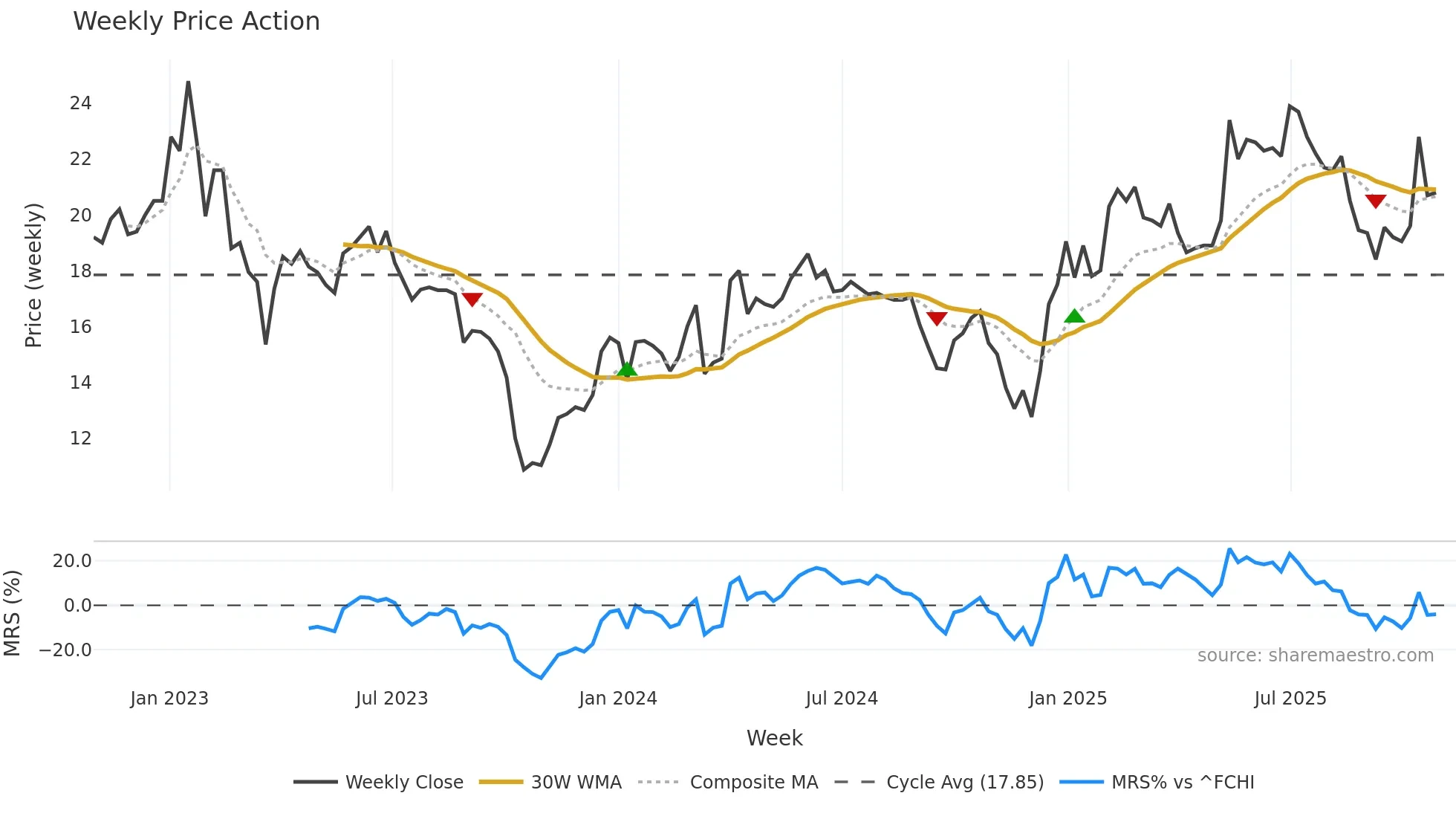

Last week closed down (-0.95%), and over the last 8 weeks price is up (13.04%) with a rising slope (2.017%/w). Ranges are expanding (current 0.46× mean; 38th pct; realised vol ≈ 7.31%). Price spends time in the middle band (rising), participation is below typical with a buying-tilt bias (z -3.65), money flow is rising, and posture is below 30w, above 50w (drawdown -8.77%). Balance is mixed; watch participation shifts and behaviour at the 30-week average.

Weekly Report (8w)

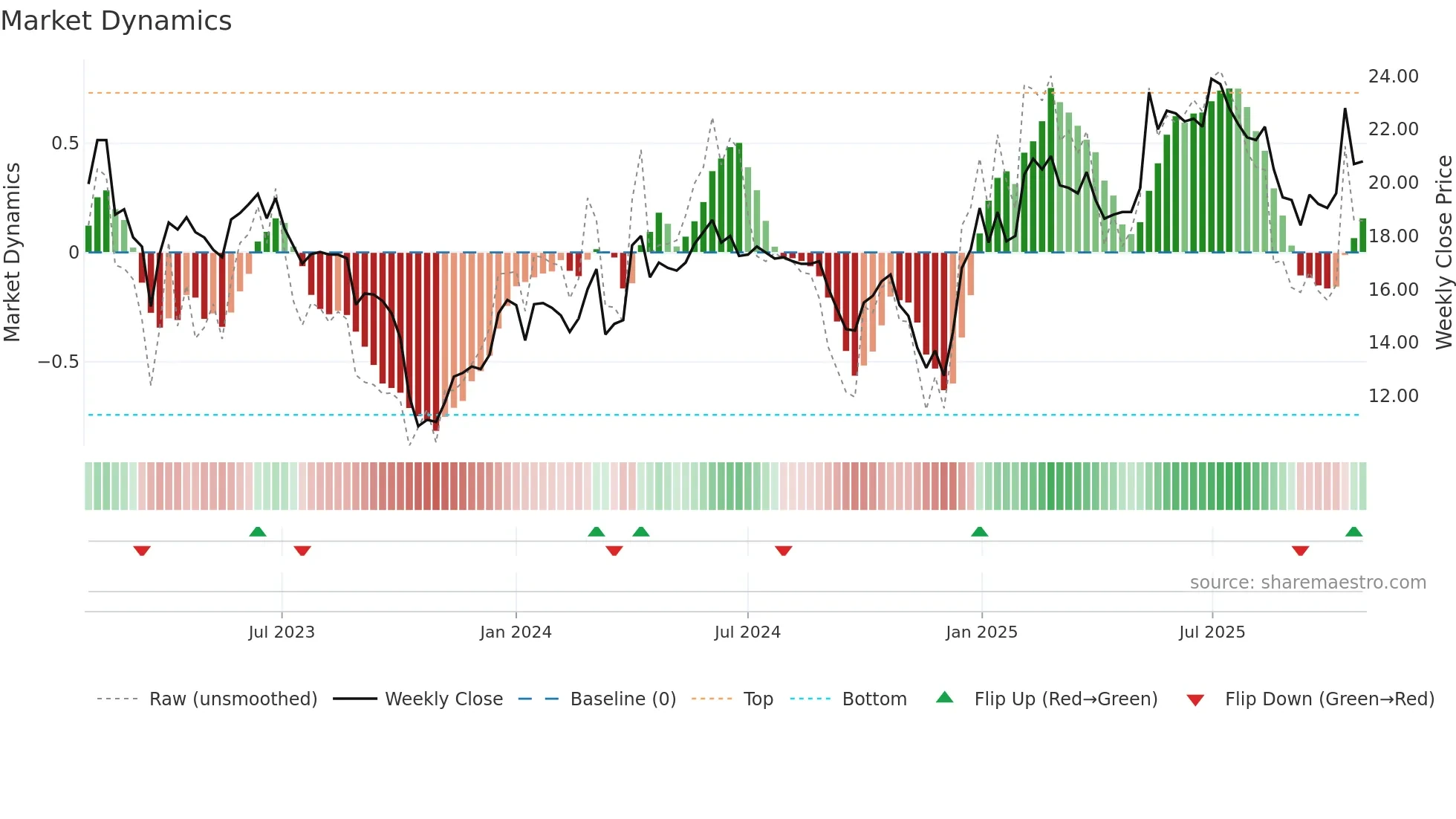

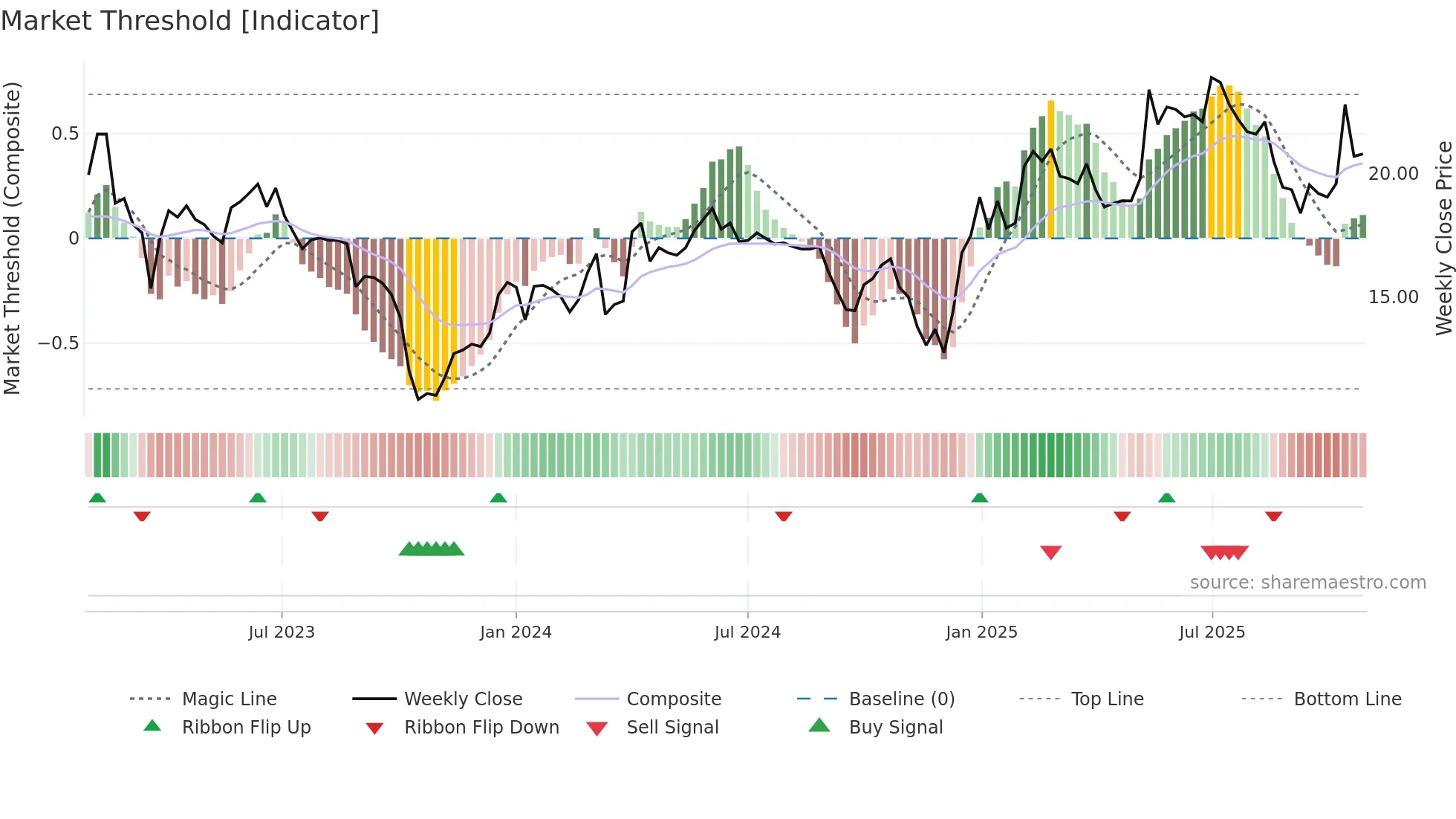

This week: market dynamics are constructive (early-trend state improving); relative strength is improving. In practical terms: backdrop leans constructive; pullbacks can be buyable if structure holds; alignment between price and intent improves reliability of advances.

- Look for shallow pullbacks holding above the 30-week average.

- Leadership tailwind: breakouts have better odds if RS continues to firm.

Market Strength

Market Regime (Activity)

Convergence / Divergence (SI vs Price)

(New − Old) / Old × 100.

Compression Ratio compares the latest range to the recent average (e.g., 0.72× means tighter than usual).

Range Percentile shows where the latest range sits within the recent distribution (e.g., 38th pct).

Realised Volatility is the standard deviation of week-to-week Close→Close % changes over the window (a volatility proxy).

0.0=lower band, 0.5=middle MA, 1.0=upper band.

Values >1 or <0 are outside the bands.

%B slope is the weekly drift of %B — rising means price is gravitating toward strength.

Band location (lower/middle/upper) and Band trend (rising/falling/flat)

summarise where price lives and whether that placement is improving.

Proprietary Analysis: All Sharemaestro charts, signals, and insights are unique to our platform. We do not follow conventional market models - this proprietary approach is what sets Sharemaestro apart.